Bank Account Number Fundamentals Explained

Wiki Article

Facts About Bank Account Number Revealed

Table of ContentsHow Bank Code can Save You Time, Stress, and Money.The Best Strategy To Use For Bank StatementBank Fundamentals ExplainedThe Best Strategy To Use For Bank Definition

You can additionally conserve your money as well as gain passion on your investment. The money stored in most financial institution accounts is government guaranteed by the Federal Down Payment Insurance Coverage Company (FDIC), approximately a limitation of $250,000 for individual depositors and $500,000 for jointly held deposits. Banks also give credit opportunities for people and also companies.

Banks make a profit by billing even more rate of interest to customers than they pay on cost savings accounts. A bank's dimension is identified by where it lies as well as who it servesfrom small, community-based institutions to large commercial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured commercial banks in the USA since 2021.

Benefit, rate of interest rates, as well as costs are some of the aspects that assist customers choose their liked banks.

The 8-Minute Rule for Bank Account

financial institutions came under intense analysis after the global monetary dilemma of 2008. The regulatory environment for banks has actually given that tightened substantially consequently. United state financial institutions are controlled at a state or nationwide level. Relying on the structure, they might be regulated at both levels. State financial institutions are managed by a state's department of banking or department of banks.

, for instance, takes down payments as well as lends in your area, which could provide an extra customized financial partnership. Select a hassle-free area if you are picking a financial institution with a brick-and-mortar location.

A Biased View of Banking

Some financial institutions additionally supply smartphone apps, which can be beneficial. Check the fees connected with the accounts you intend to open. Financial institutions charge passion on car loans in addition to monthly upkeep costs, overdraft account costs, and also cable transfer costs. Some huge financial institutions are transferring to finish overdraft account charges in 2022, to ensure that could be an important factor to consider.Money & Development, March 2012, Vol (banking). 49, No. 1 Institutions that match up savers as well as borrowers aid make certain that economies operate efficiently YOU have actually got $1,000 you don't require for, claim, a year and also want to make revenue from the cash till after that. Or you desire to purchase a residence and need to obtain $100,000 as well as pay it back over three decades.

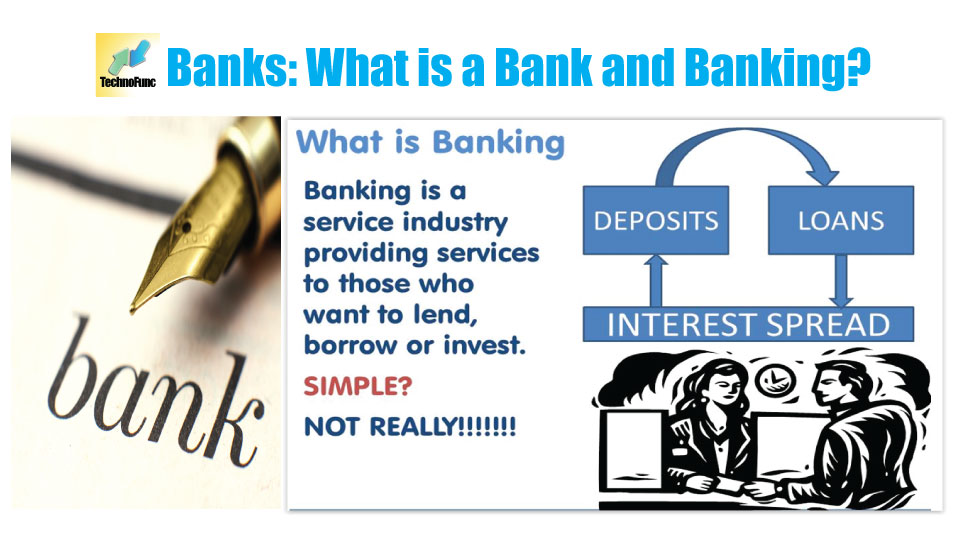

That's where banks are available in. Although banks do many things, their main duty is to absorb fundscalled depositsfrom those with money, pool them, as well as offer them to those who need funds. Banks are intermediaries between depositors (that provide cash to Full Report the bank) and debtors (to whom the financial institution provides cash).

Depositors can be individuals and also homes, monetary and nonfinancial firms, or nationwide as well as regional federal governments. Customers are, well, the same. Deposits can be offered as needed (a bank account, for instance) or with some restrictions (such as cost savings and also time down payments). While at any given minute some depositors require their money, many do not.

The smart Trick of Bank Statement That Nobody is Discussing

The procedure entails maturity transformationconverting short-term liabilities (down payments) to lasting properties (fundings). Banks pay depositors less than they get from debtors, which difference accounts official website for the mass of banks' earnings in many countries. Financial institutions can complement traditional deposits as a source of funding by straight borrowing in the cash as well as funding markets.

Banks keep those needed reserves on deposit with main financial institutions, such as the United State Federal Book, the Financial Institution of Japan, and the European Central Bank. Banks produce money when they provide the remainder of the cash depositors provide. This cash can be used to acquire products as well as services as well as can discover its back into the banking system as a down payment in another bank, which after that can lend a fraction of it.

The size of the multiplierthe quantity of cash created from an initial depositdepends on the amount of cash financial institutions must go on reserve (bank statement). Banks additionally provide as well as reuse excess cash within the monetary system and develop, disperse, and profession protections. Banks have numerous means of generating income besides pocketing the difference (or spread) between the passion they pay on deposits as well as borrowed cash and the interest they collect from customers or protections they hold.

Report this wiki page